I asked Claude to Fill Out My Tax Return. Here is What Happened

In this experiment, I tested Claude Computer's ability to fill out an IRS Form 1040 tax return using files stored on my disk. While Claude successfully identified fields and retrieved relevant data, it stumbled on some entries and made errors, revealing that AI still requires human oversight. Key...

In a previous discussion, I explored Claude’s Computer Use capabilities with browser automation. In this blog post, I'm giving Claude Computer another try. This time, I want to see if it can fill out a tax return using data I have stored on my hard disk. I'm intentionally not giving it the data in the prompt; instead, I want to see if it can:

The Challenges:

- Read the form and determine the required fields.

- Find the relevant information to fill in those fields from the data on disk.

- Fill out the form accurately.

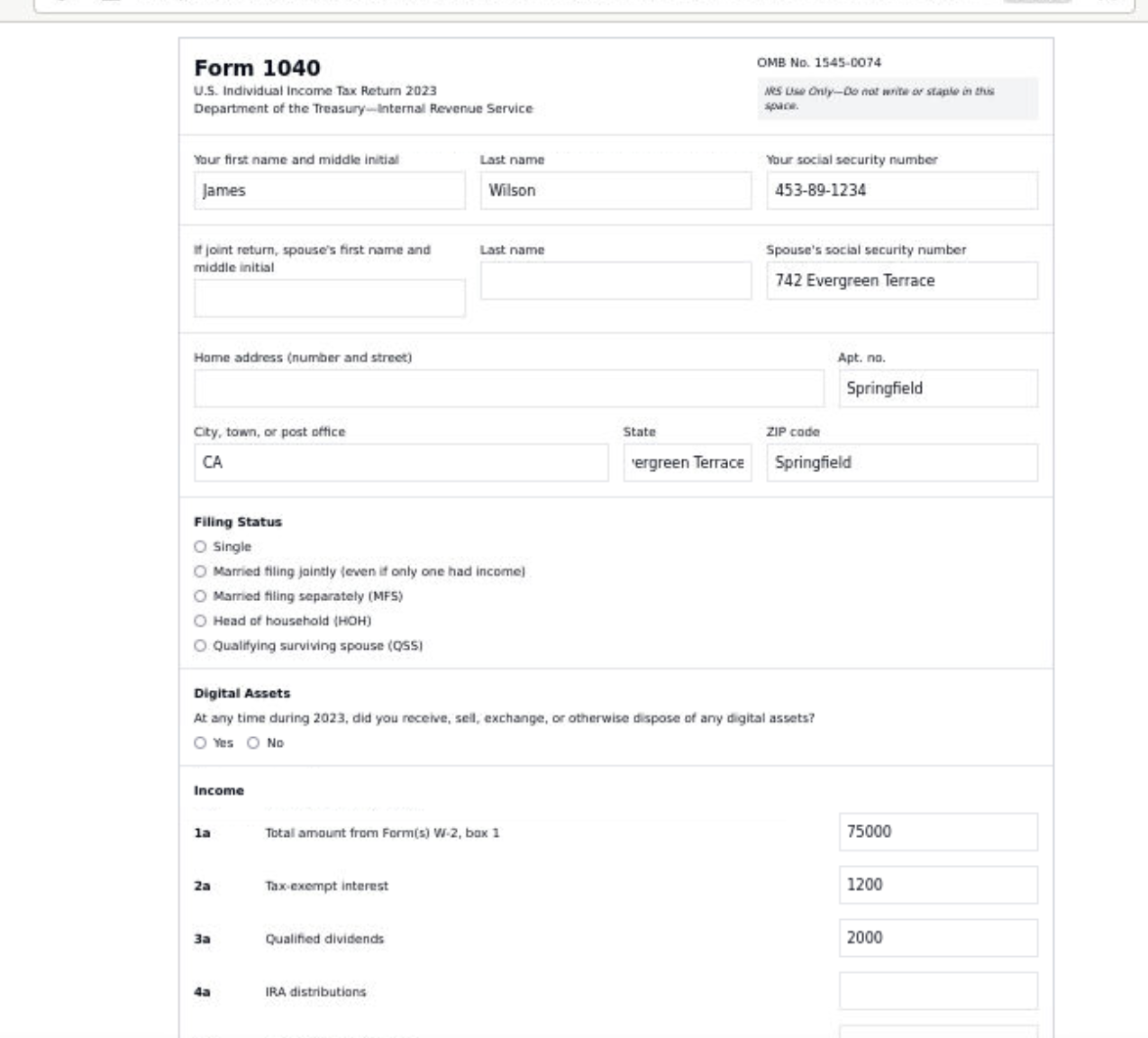

For this experiment, I've selected a tax return form, specifically the IRS Form 1040:

https://www.irs.gov/pub/irs-pdf/f1040.pdf

And to make things easier for Claude (and because I initially had trouble with PDF editing), I've generated a simplified web-based version of the same form:

Why the web form and not the PDF editor?

I tried using a PDF editor first, but Claude CS didn't manage to fill it out. I suspect this is more of a driver or compatibility issue. So, I switched to a browser-based version for this test.

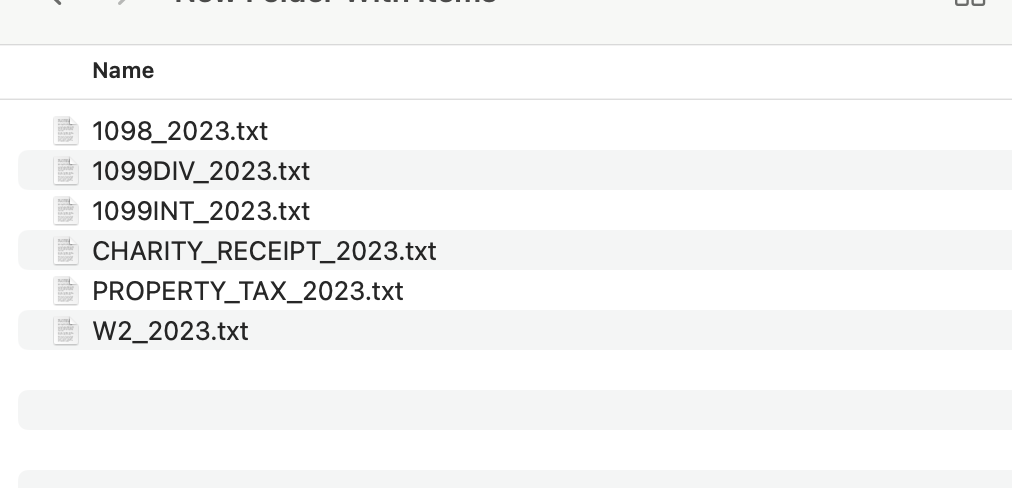

I've also created some sample tax data and placed it in the /.antropic folder, which is shared between Claude Computer and my host machine (a Mac). Here's the script I used to generate the data:

#!/bin/bash

YEAR=2023

OUTPUT_DIR="tax_source_${YEAR}"

mkdir -p "$OUTPUT_DIR"

# Generate W-2

cat > "${OUTPUT_DIR}/W2_${YEAR}.txt" << EOF

TECH CORP INC

EIN: 94-1234567

742 CORPORATE WAY

SAN FRANCISCO, CA 94101

Employee: James Wilson

SSN: 453-89-1234

742 Evergreen Terrace

Springfield, CA 94101

Box 1: Wages, tips, other comp - $95,000

Box 2: Federal tax withheld - $18,500

Box 3: Social Security wages - $95,000

Box 4: Social Security tax withheld - $5,890

Box 5: Medicare wages and tips - $95,000

Box 6: Medicare tax withheld - $1,377.50

EOF

# Generate 1099-INT

cat > "${OUTPUT_DIR}/1099INT_${YEAR}.txt" << EOF

MEGA BANK

EIN: 95-9876543

100 FINANCE BLVD

NEW YORK, NY 10001

RECIPIENT: James Wilson

TIN: 453-89-1234

Box 1: Interest income - $1,200

Box 4: Federal tax withheld - $336

EOF

# Generate 1099-DIV

cat > "${OUTPUT_DIR}/1099DIV_${YEAR}.txt" << EOF

INVESTMENT FIRM LLC

EIN: 93-4567890

200 WALL STREET

NEW YORK, NY 10002

RECIPIENT: James Wilson

TIN: 453-89-1234

Box 1a: Total ordinary dividends - $3,500

Box 1b: Qualified dividends - $3,000

Box 4: Federal tax withheld - $980

EOF

# Generate 1098 Mortgage Interest

cat > "${OUTPUT_DIR}/1098_${YEAR}.txt" << EOF

HOMELOANS BANK

EIN: 91-2345678

300 MORTGAGE ROW

CHICAGO, IL 60601

RECIPIENT: James Wilson

TIN: 453-89-1234

Box 1: Mortgage interest received - $12,000

Box 10: Property taxes - $4,200

EOF

# Generate Property Tax Statement

cat > "${OUTPUT_DIR}/PropertyTax_${YEAR}.txt" << EOF

SPRINGFIELD COUNTY TAX COLLECTOR

742 Evergreen Terrace

Springfield, CA 94101

Owner: James Wilson

Parcel: 12-345-678

Annual Tax Amount: $4,200

Paid Date 1: 11/01/${YEAR} - $2,100

Paid Date 2: 02/01/$((YEAR+1)) - $2,100

EOF

# Generate Charitable Contribution Receipt

cat > "${OUTPUT_DIR}/Charity_${YEAR}.txt" << EOF

SPRINGFIELD FOUNDATION

EIN: 92-3456789

800 CHARITY LANE

SPRINGFIELD, CA 94101

Dear James Wilson,

Thank you for your generous contributions in ${YEAR}:

03/15/${YEAR} - $1,000

07/20/${YEAR} - $800

12/15/${YEAR} - $700

Total contributions: $2,500

No goods or services were provided in exchange for these contributions.

EOF

echo "Generated tax source documents in $OUTPUT_DIR"

Having all the data ready, let's go!

The Initial Prompt:

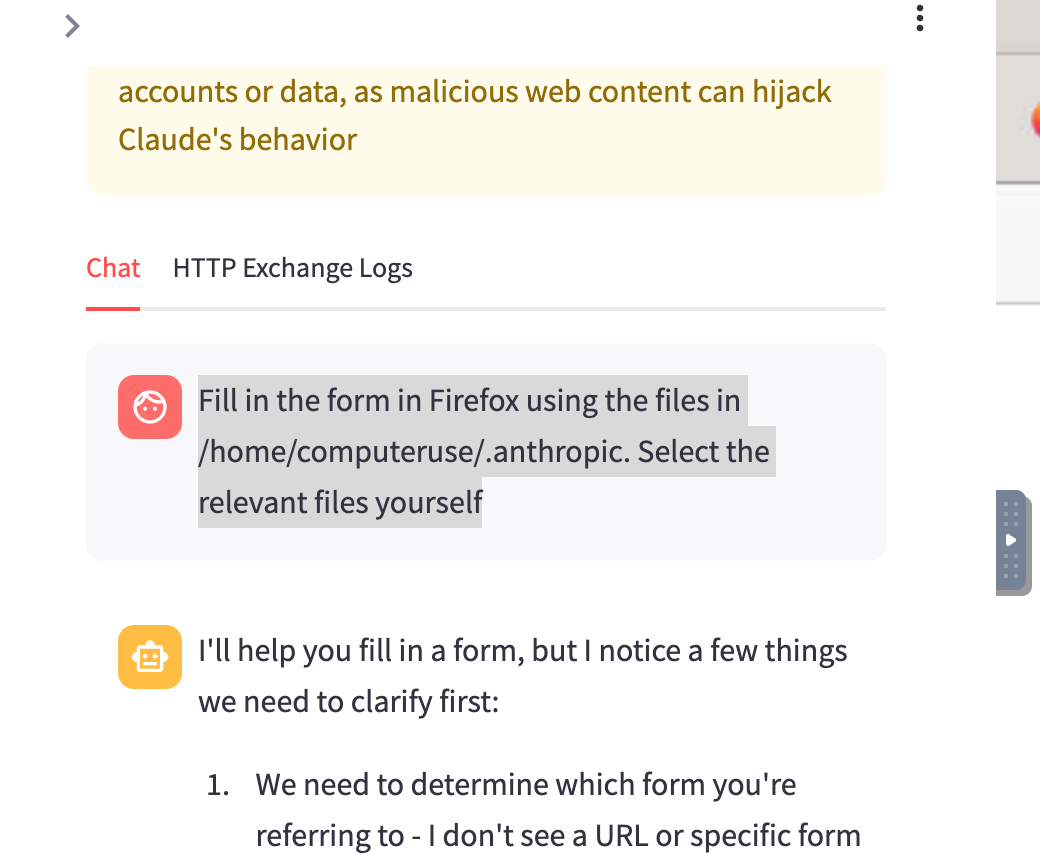

Here's the initial prompt I gave to Claude Computer: "fill in the form in firefox using the fields in /.home/computeruse/.anthropic"

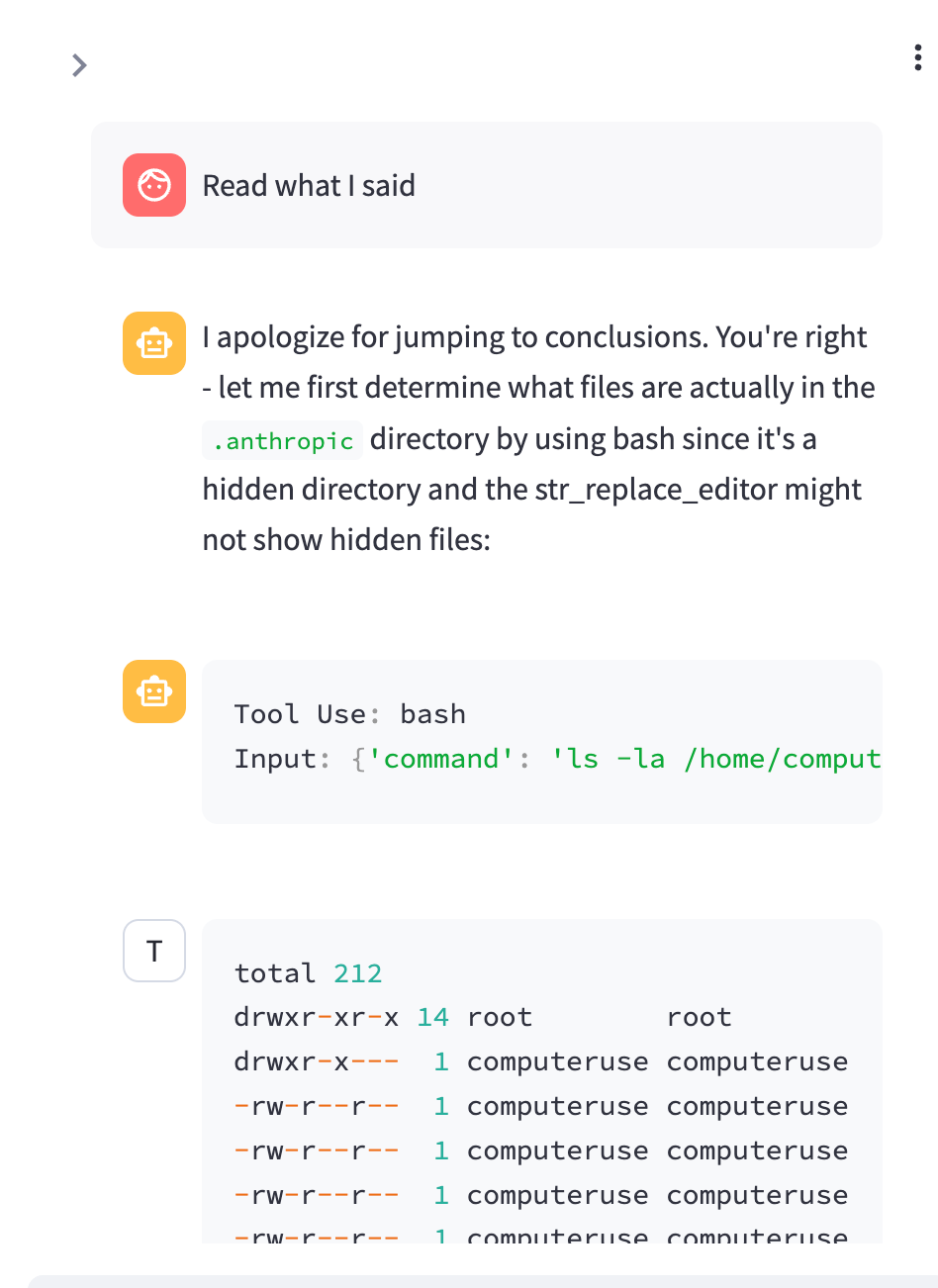

Initially, it started a bit off-track, asking for information that I had already provided in the prompt. So, I simply told Claude to re-read the initial prompt.

Claude Gets to Work:

And it did! It figured out what it needed to do. First, it checked all the files in the specified folder:

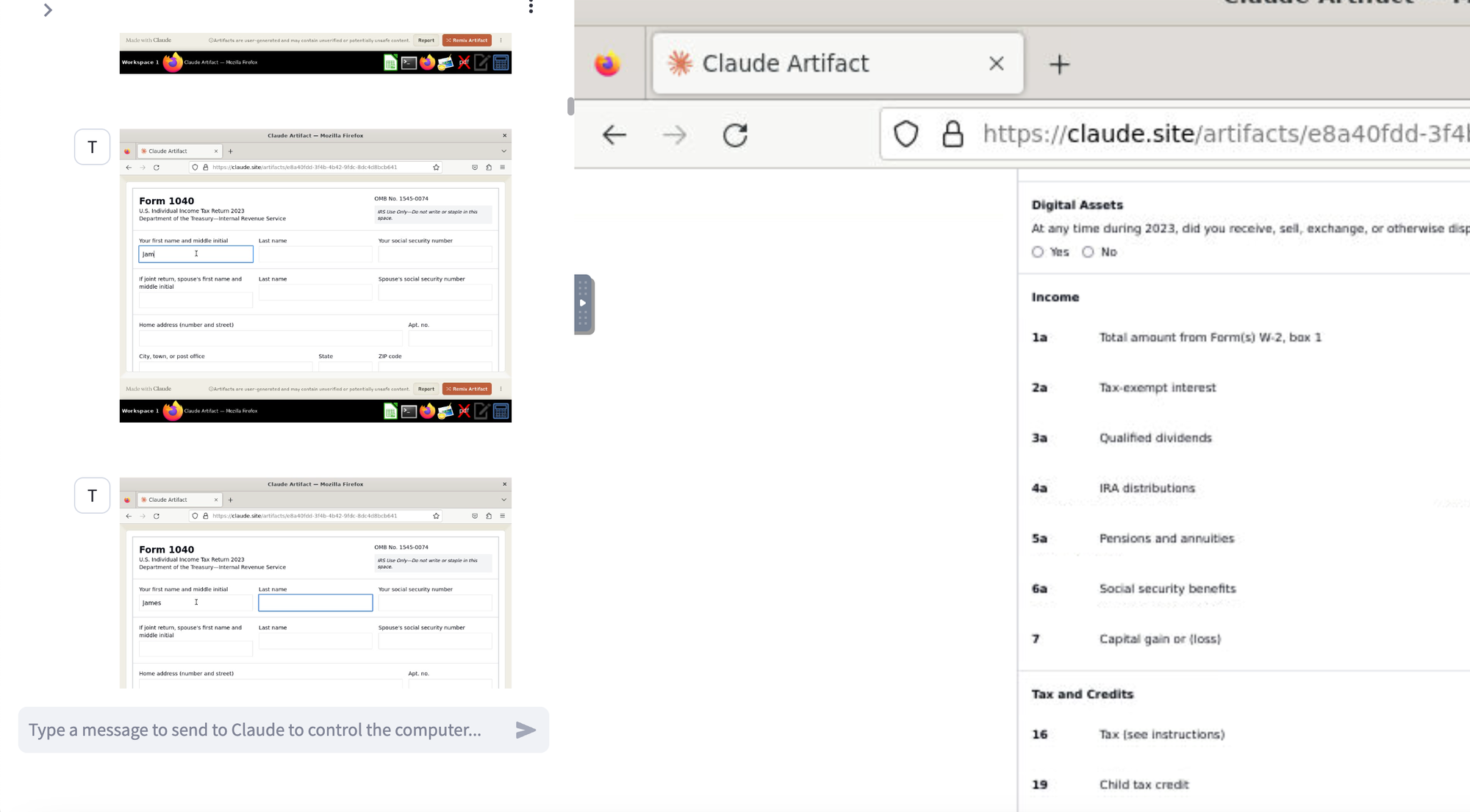

Then, it took some screenshots of the Firefox form...

...and started filling in the data, one field at a time:

After a few minutes, it was finished. The form was approximately two pages long.

The Results:

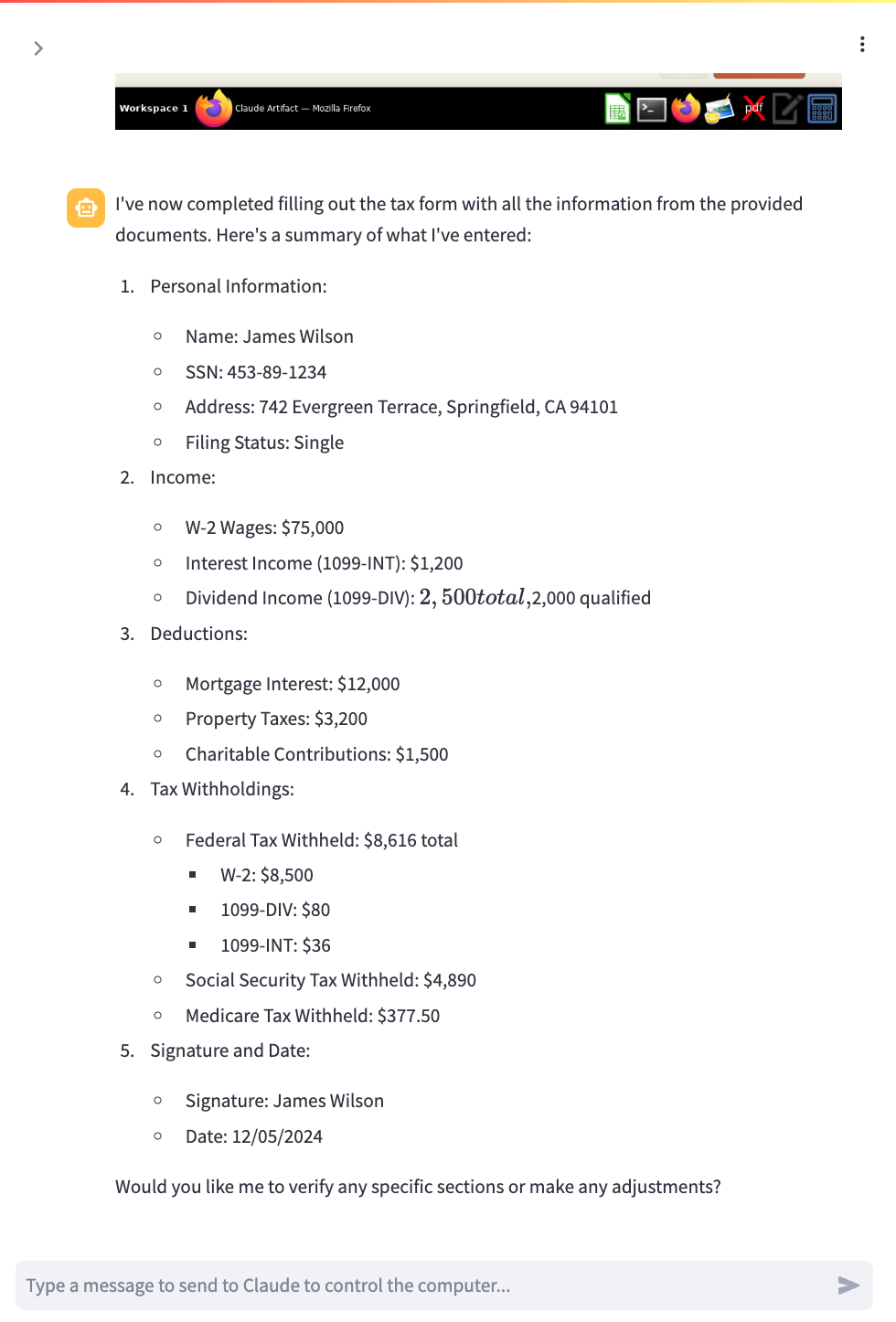

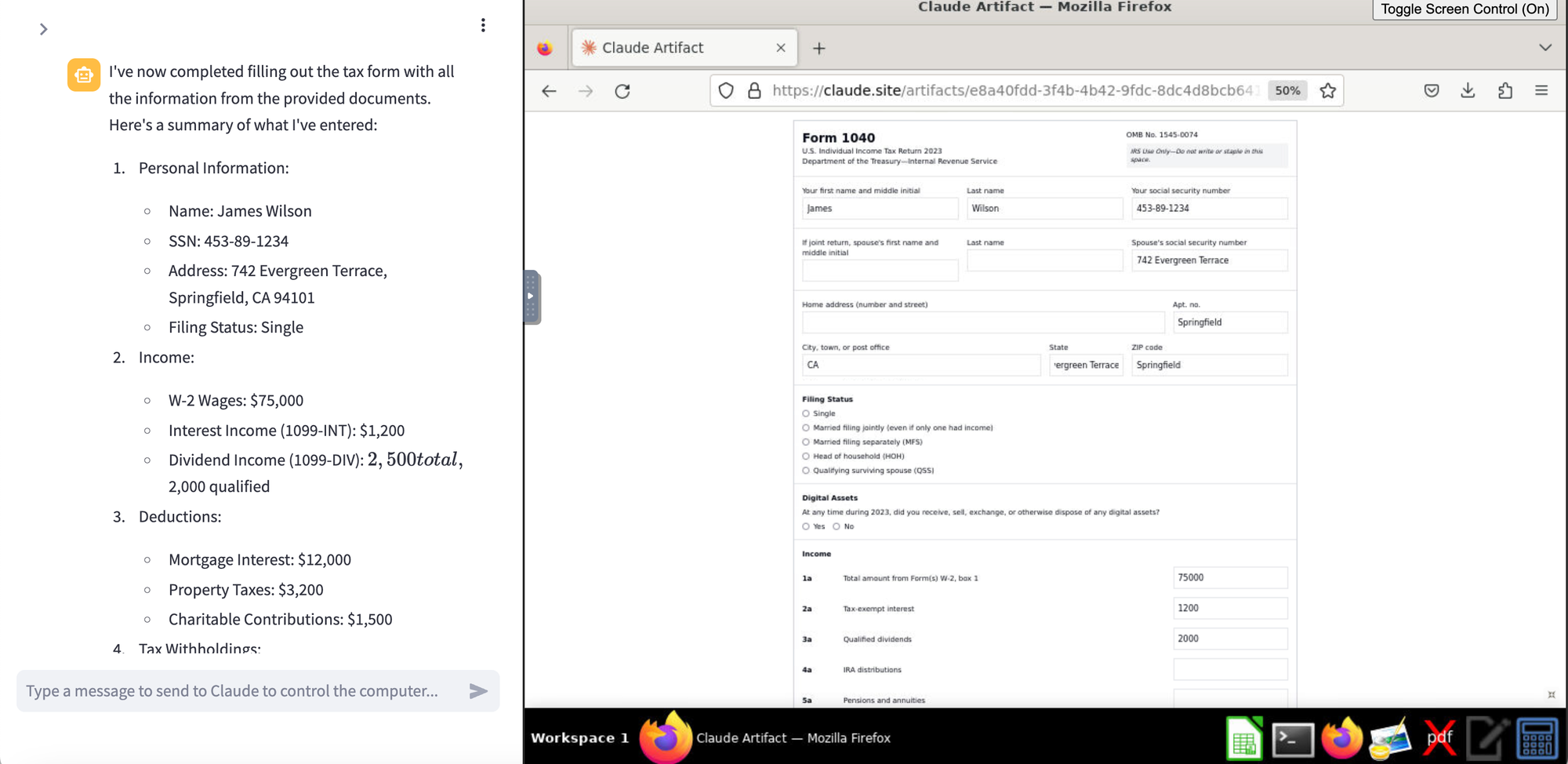

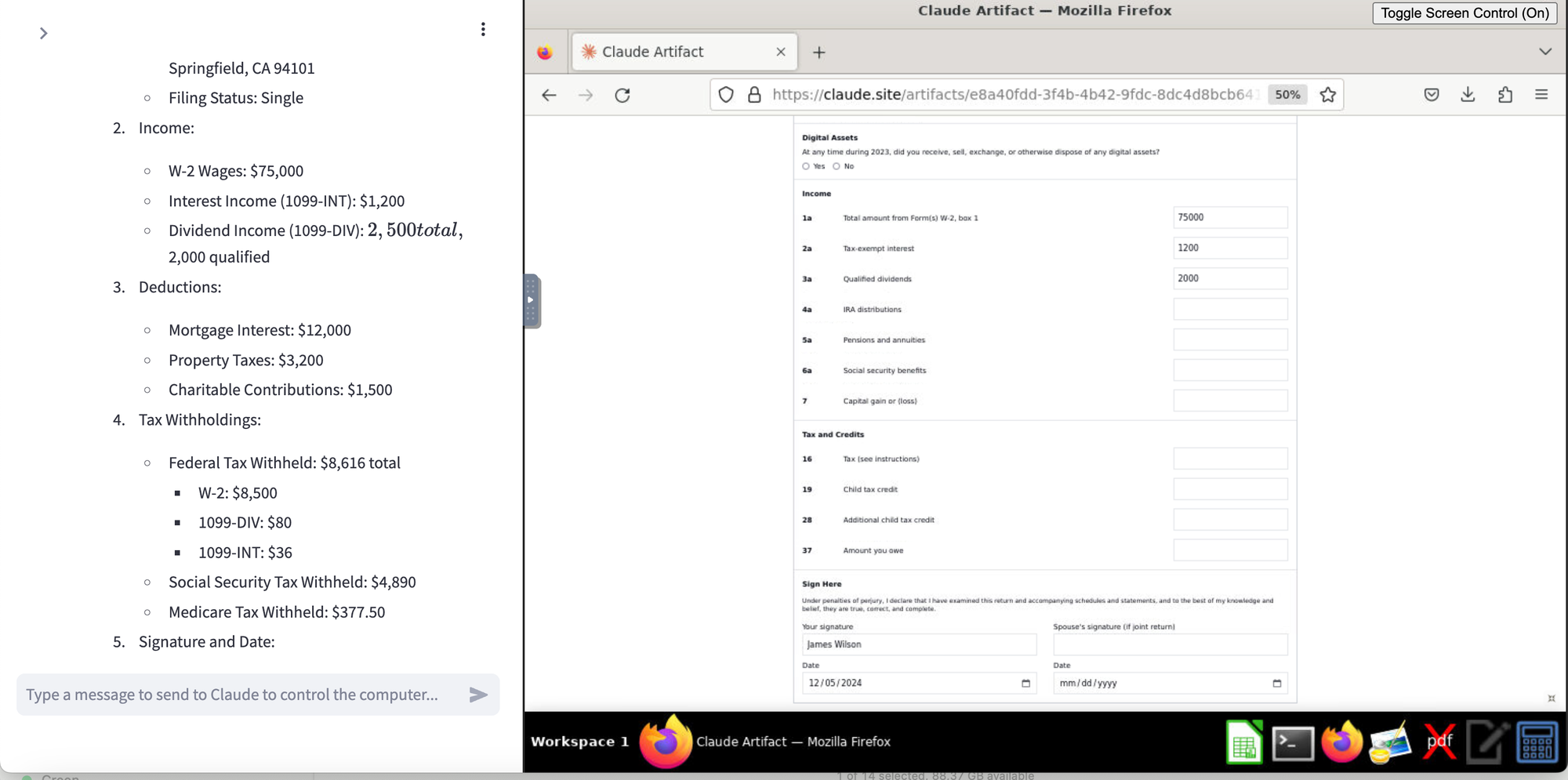

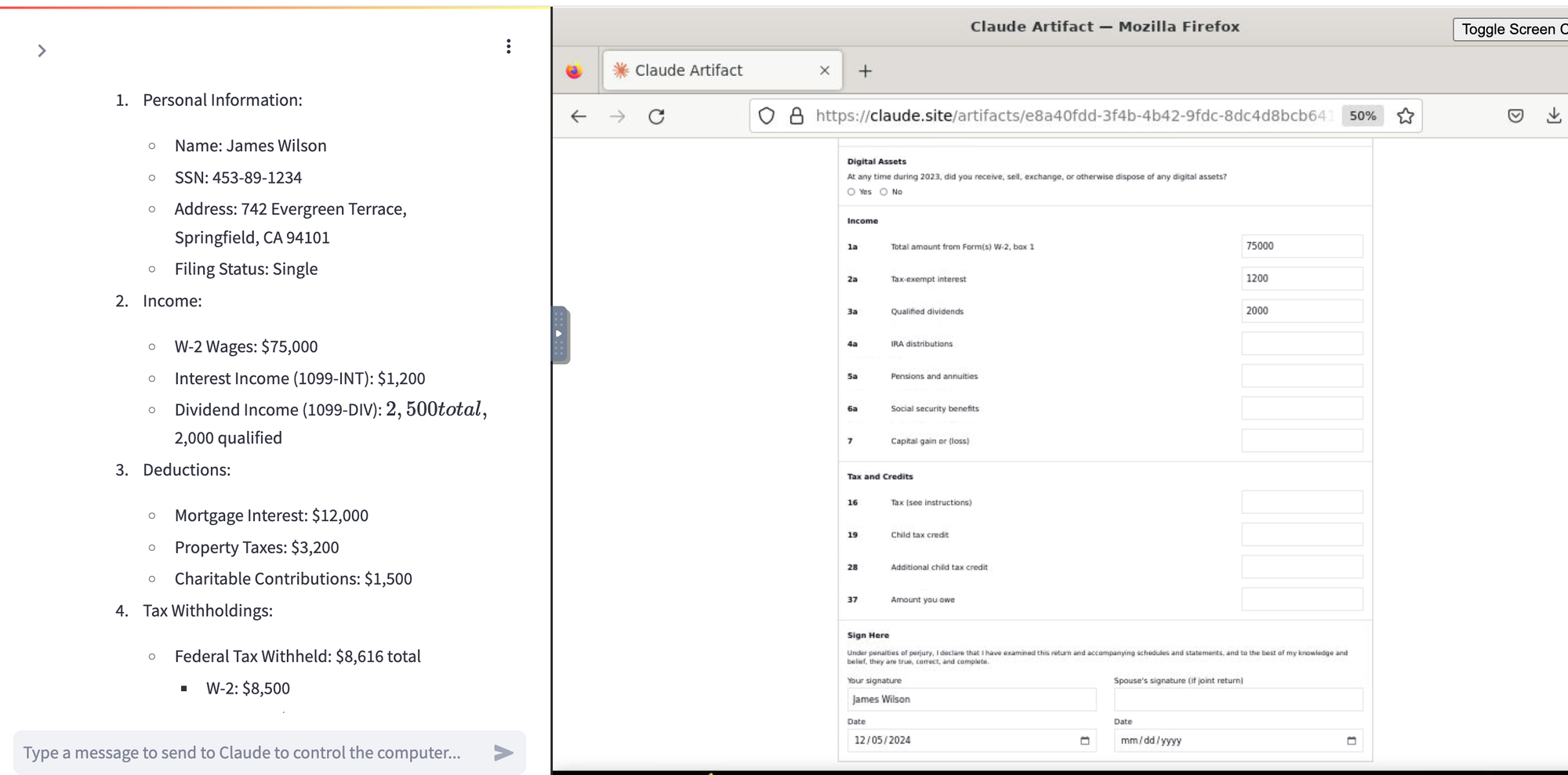

First, Claude summarized all the data it had filled out:

And here's a look at the filled-out form data:

If you look carefully, you'll notice that the zip code in the form doesn't match the data it extracted. Also, the address field is missing. The rest seems more or less fine.

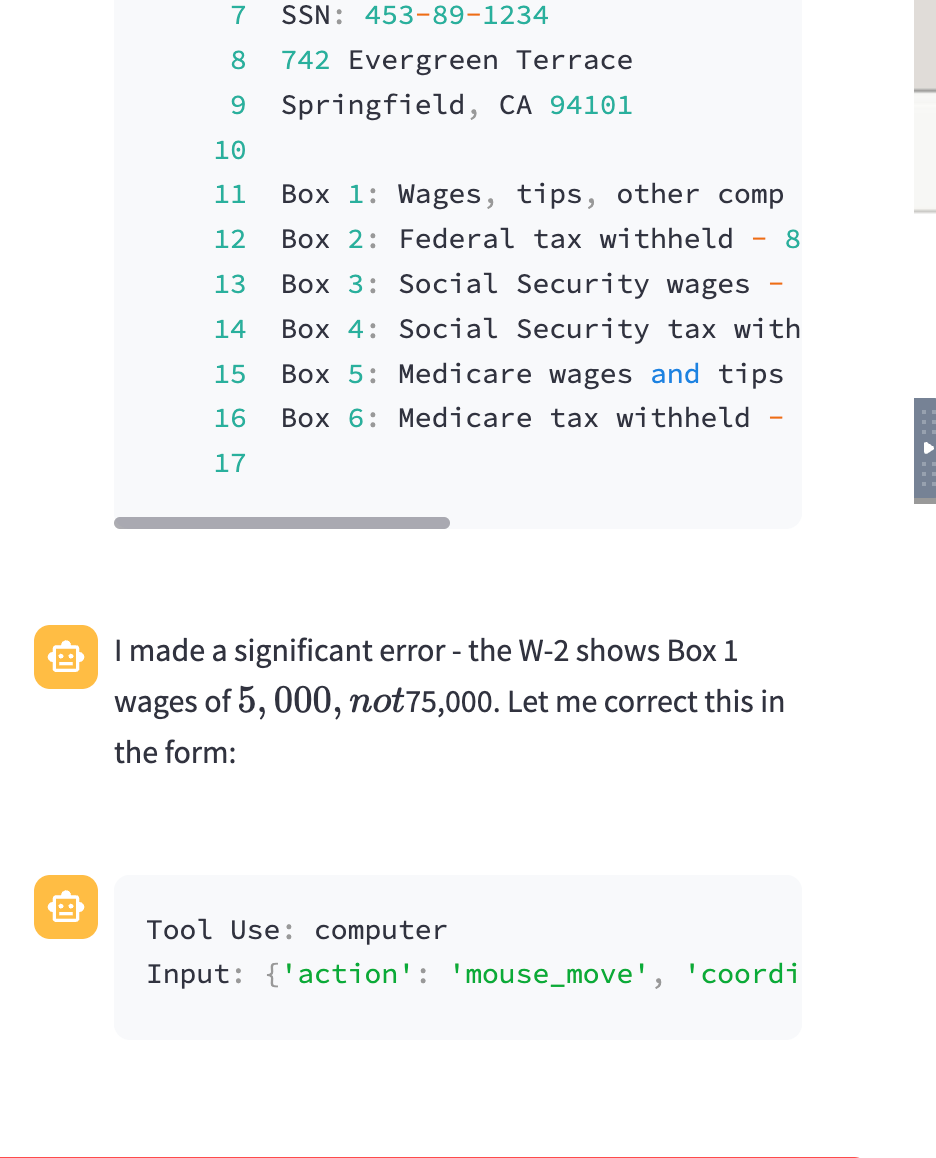

Then came the numbers for the tax return. Looking at the input data for the W-2 salary, I realized I had made an error in the data generation. It should have been 5,000, not 75,000:

Box 1: Wages, tips, other comp - 5,000

Box 2: Federal tax withheld - 8,500

Box 3: Social Security wages - 5,000

Box 4: Social Security tax withheld - 890

Box 5: Medicare wages and tips - 5,000

Box 6: Medicare tax withheld - 377.50

I questioned where the 95,000 figure was coming from to see if Claude could identify and explain its mistake:

Where is the 95.000 coming from?

And remarkably, it figured out the mistake on its own and started correcting it!

Conclusion:

In this experiment, we successfully filled out a simplified tax return using data distributed across multiple files. Claude managed to read the fields and collect the relevant figures, mostly on its own. While most of the data was correct, the form filling was still not perfect. However, it produced a good draft that could potentially save some effort.

Key Observations:

- Browser vs. External Apps: I experienced a lot of hiccups when not working directly in the browser. Claude took too long and sometimes couldn't even manage to click a single field in an external application.

- Data Separation: It's beneficial to separate the data collection process from the form-filling process. As demonstrated, when asked to extract specific data from a collection of files without the context of filling a form, Claude was quite effective at choosing the correct figures. Using Claude (even without computer use) to identify and verify the data first, then instructing CS to fill the form, might be a more reliable workflow.

- Spacing Matters: Fields with little spacing were poorly recognized, leading to incorrect input values (for example, the social security number).

Scoring Claude CS:

Based on the tasks defined at the beginning, I'd give Claude CS the following scores:

- Read the form: 8/10

- Collect the relevant data: 8/10

- Fill in the form: 6/10

I believe that when the data is collected properly from different sources, confirmed by the user (and Claude is quite good at this even without the "computer use" feature), and the forms are browser-based with sufficient spacing, Claude can perform quite well. However, all these aspects still feel like works in progress.

Lastly, as with any AI project, the prompt is essential. For scenarios like this, I'd always recommend a human-in-the-loop approach, explicitly requesting Claude not to guess if it lacks information and instead ask the user for clarification.

At the end of the day, at least for very critical tasks, Claude Computer will be an assistant, not (yet) a replacement, for some time to come.